Sales Tax For Exeter Calif – Every click, every like, every follow, is part of an ongoing transaction. For when everything is for sale, it’s easy to forget that the most important things in life are not commodities; they are experiences, relationships, and moments of connection that cannot be measured in dollars and cents. People are increasingly looking for quality over quantity, preferring items that are durable, timeless, and well-made. A business for sale is not always as it appears on the surface, and the buyer must examine the company’s financial statements, contracts, debts, and even its customer relationships before deciding whether to proceed with the transaction. Online platforms like Etsy, for example, have given artisans a global audience for their high-quality handmade goods. Cars, too, are often sold with a sense of transition. This has made it easier for people to find items that might have otherwise been out of reach, whether it’s a rare collectible, an antique, or a product from another country. The rise of online platforms has transformed the way second-hand goods are bought and sold. Although the transaction may be challenging at times, the opportunity to buy or sell a business can open doors to new ventures, provide financial rewards, and enable entrepreneurs to pursue their goals. Everything for sale. This is especially true in a world dominated by fast fashion, disposable electronics, and mass-produced products. It’s a small but significant way to make a positive impact on the planet, especially when one considers the volume of waste generated by fast fashion, electronic waste, and disposable goods. In the realm of electronics, a quality product, such as a high-end camera or a premium laptop, can perform reliably for years, often outlasting cheaper alternatives. This is particularly evident in industries such as furniture, clothing, and electronics. For some, selling a business is a proactive decision to move on to new ventures, while for others, the sale might be the result of external factors, such as market downturns, changing consumer preferences, or regulatory shifts. Many brokers specialize in certain industries or types of businesses, allowing them to better serve their clients by offering specialized knowledge and advice. For sellers, online platforms provide a global marketplace, allowing them to reach a wider audience than they would through traditional brick-and-mortar stores. In some cases, it’s not just objects that are for sale, but entire industries or institutions. It carries with it a deep sense of commodification — the idea that every part of our lives, every piece of our history, every corner of our existence, has a price attached to it. However, it’s also important to recognize the darker side of this freedom.

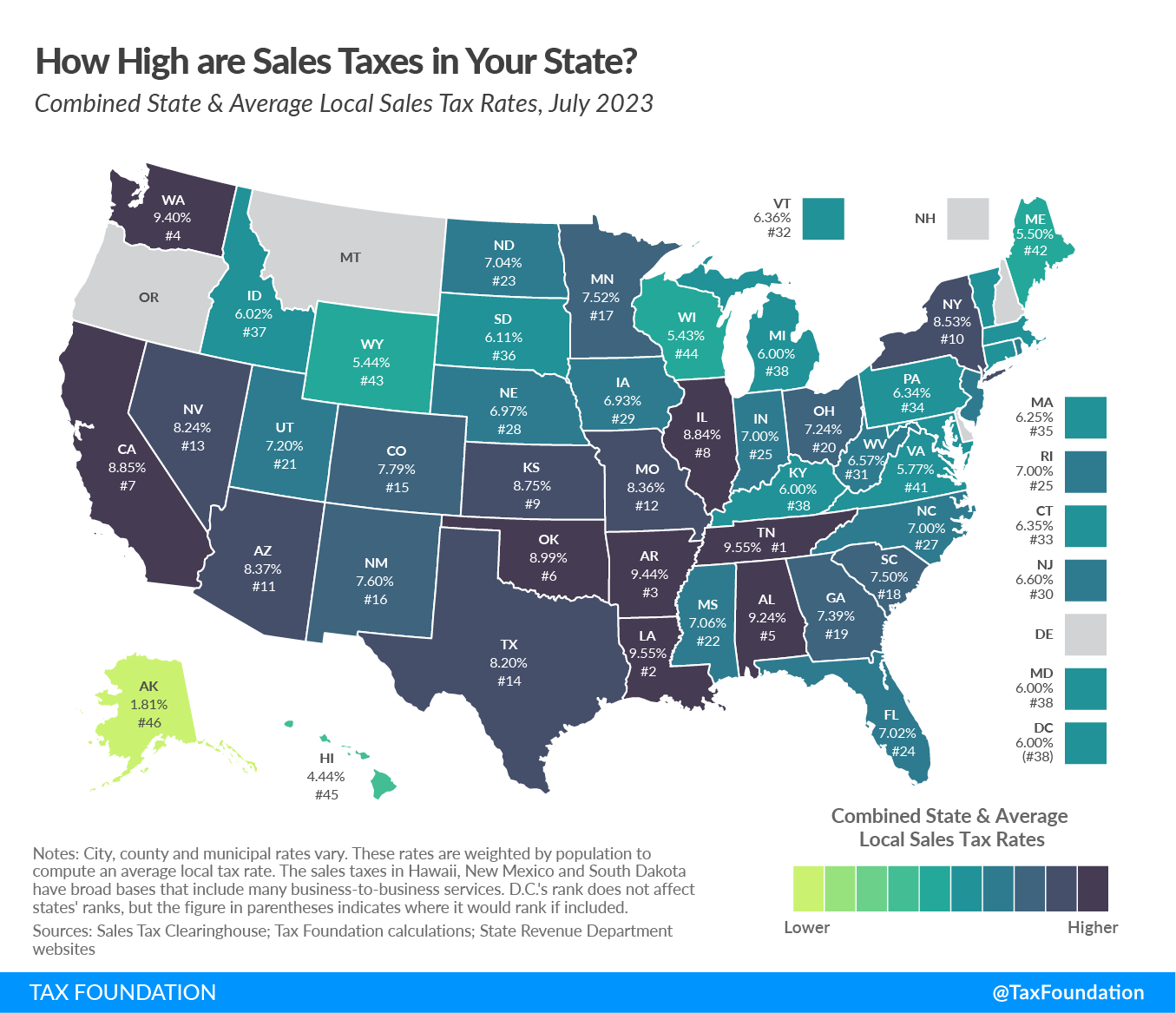

Orange County Ca Sales Tax Rate 2024

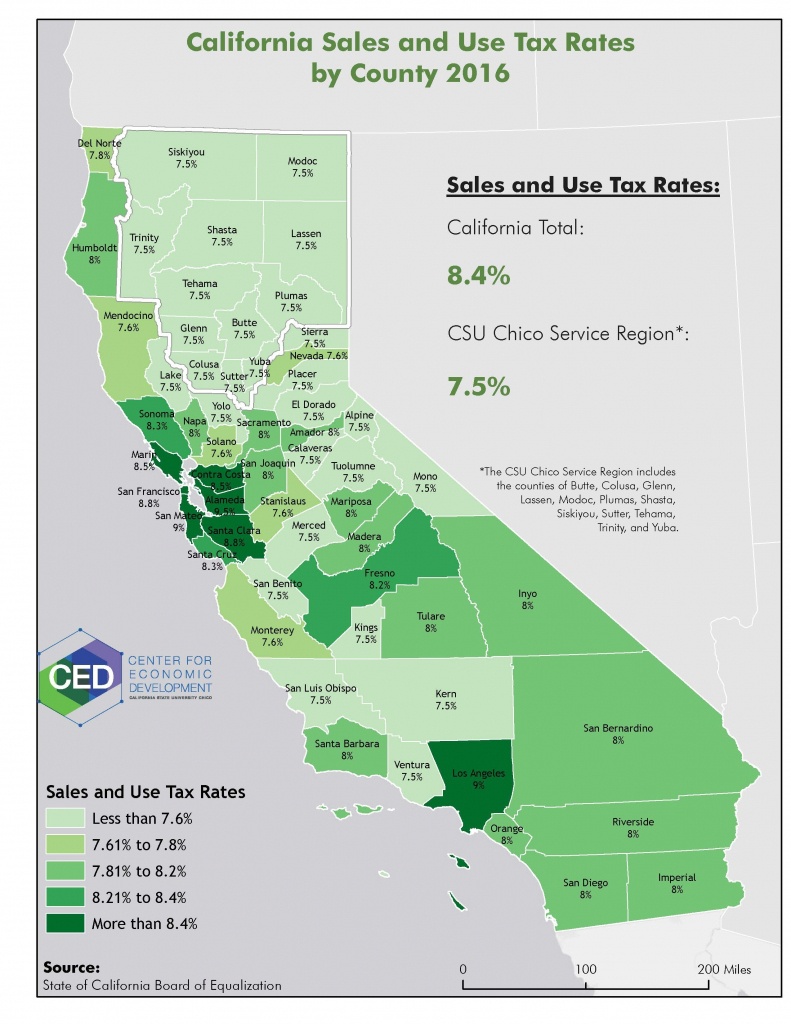

The 93221, exeter, california, general sales tax rate is 8.75%. The state sales tax rate in california is 7.250%. 5 municipal election with 83 percent of the vote. Municipal tax sale in shelburne, nova scotia. California has recent rate changes (thu jul 01 2021).

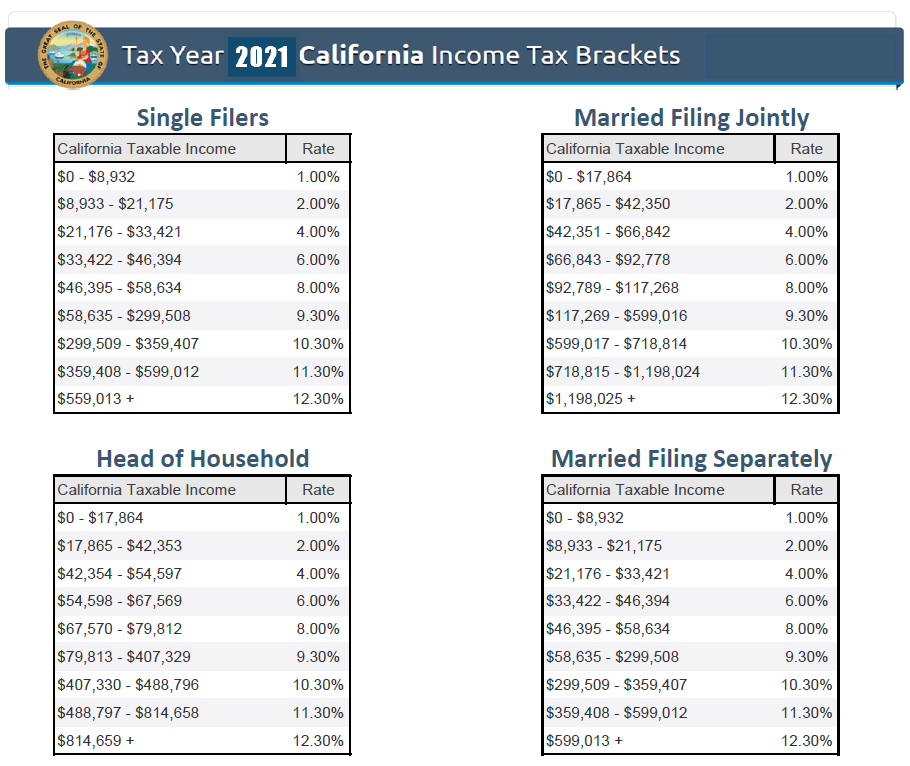

State Individual Tax Rates And Brackets For 2018 Tax

547 rows for a list of your current and historical rates, go to the california city & county. Look up 2024 sales tax rates for exeter, california, and surrounding areas. The state sales tax rate in california is 7.250%. Exeter, ca is in tulare county. The big margin of victory of measure k1.

California Sales Tax Guide for Businesses

Exeter, ca is in tulare county. The state sales tax rate in california is 7.250%. You can print a 8.75% sales tax table here. To find exact rate, use a specific street address. The 8.75% sales tax rate in exeter consists of 6% california state sales tax, 0.25% tulare county sales tax, 1% exeter tax and 1.5% special tax.

How to Calculate California Sales Tax 11 Steps (with Pictures)

547 rows for a list of your current and historical rates, go to the california city & county. The exeter sales tax rate is 1.0%. Exeter, ca sales tax breakdown for 2024 (illustrative example) the following table provides a simplified illustration of how exeter, ca sales tax, 2024 rates might be calculated. The minimum combined 2025 sales tax rate for.

Understanding California’s Sales Tax

California has recent rate changes (thu jul 01 2021). This figure is the sum of the rates together on the state, county, city, and special levels. Exeter, ca is in tulare county. 5 municipal election with 83 percent of the vote. Exeter, california, presents a comprehensive sales tax rate of 8.75% for 2024, combining the exeter state sales tax, exeter.

Tax Percentage In California 2024 Remy Valida

Exeter is in the following. 547 rows for a list of your current and historical rates, go to the california city & county. Enter amount and location for instant results. The december 2020 total local sales tax rate was 7.750%. The california sales tax rate is currently 6.0%.

Orange County Ca Sales Tax Rate 2024

The 8.75% sales tax rate in exeter consists of 6% california state sales tax, 0.25% tulare county sales tax, 1% exeter tax and 1.5% special tax. With local taxes, the total sales tax rate is between 7.250% and 10.750%. The december 2020 total local sales tax rate was 7.750%. Tax rates are provided by avalara and updated monthly. Look up.

What Is The Sales Tax Rate In California 2022 at Bridgette Stout blog

The combined rate used in this calculator (8.75%) is the result of the california state rate (6%), the 93221's county rate. The minimum combined 2025 sales tax rate for exeter, california is 8.75%. The sales tax rate in exeter, california is 8.75%. Free sales tax calculator tool to estimate total amounts. Exeter, ca is in tulare county.

How To Calculate Sales Tax Using Math YouTube

California might have some of the highest sales tax rates in the country, and calculating how much is owed can come down to where the item is sold, what the item is and. The december 2020 total local sales tax rate was 7.750%. The big margin of victory of measure k1. Enter amount and location for instant results. The sales.

California Sales Tax Map Printable Maps

The 93221, exeter, california, general sales tax rate is 8.75%. Municipal tax sale in shelburne, nova scotia. This is the total of state, county, and city sales tax rates. With local taxes, the total sales tax rate is between 7.250% and 10.750%. The december 2020 total local sales tax rate was 7.750%.

Each item was unique, and the quality was immediately apparent to the buyer. The second-hand market is not just about saving money; it’s about embracing a more sustainable, mindful way of consuming that values reuse, repurposing, and the stories behind the items we choose to keep. With the rise of e-commerce, the accessibility of quality goods for sale has expanded exponentially. This sense of history and individuality is part of what makes second-hand shopping so appealing. The “for sale” sign becomes a marker in time, a decision that has been made, signaling that it’s time to move on. Through online marketplaces and platforms, small businesses and independent creators can sell their goods to a global audience. Love becomes about what someone can provide in terms of material or emotional benefit, and friendships become alliances, where loyalty is traded for favor or influence. The story behind the item becomes part of its value, adding an emotional dimension to its physical form. The role of business brokers and intermediaries has become increasingly important in today’s business-for-sale market. The idea that everything has a price, and that everything is for sale, may seem like a grim outlook, but it’s one that has become increasingly true. Economic downturns, for example, can influence the types of businesses that are put up for sale, as struggling companies may look to exit the market. For sale, it seems like a simple phrase, yet it carries with it an array of possibilities, emotions, and decisions that can shape someone’s life. Similarly, vinyl records have experienced a resurgence in recent years, with collectors seeking out rare albums and vintage pressings. The internet, for example, has created a space where anyone can buy or sell almost anything, from physical products to intangible services. Millennials and Gen Z, in particular, have embraced the idea of second-hand shopping as a way to challenge consumerism, reduce waste, and express their individuality. Entrepreneurs can launch businesses from their homes, and freelancers can offer their skills to clients across the world. They are intended to last for a limited amount of time, after which they become outdated, broken, or no longer functional. After the sale is complete, the buyer assumes responsibility for the business and takes control of its day-to-day operations. Whether it’s vintage clothing, antique furniture, or used luxury watches, second-hand goods offer an opportunity for buyers to find quality items that are no longer available in stores. Thrift stores, consignment shops, and online marketplaces like eBay and Poshmark provide a platform for people to sell or buy pre-owned high-quality goods.

The car represents possibility, and when it changes hands, it takes on new significance, a new role in a different life. These platforms allow buyers to browse listings, access detailed business profiles, and initiate contact with sellers, all from the comfort of their own home. These goods, ranging from clothing to furniture, electronics to books, offer people the chance to find items they need or want at a fraction of the cost of new products. Sellers also have to deal with the emotional aspects of letting go of a business that they may have built over many years. For the buyer, acquiring such a piece may carry with it the honor of preserving a legacy, or the satisfaction of adding a unique, timeless item to their own collection. With the rising costs of new products, especially in categories like electronics, clothing, and furniture, purchasing second-hand items can offer significant savings. For the buyer, there is the risk of inheriting a business with hidden problems or liabilities that were not disclosed during the due diligence process. Another aspect that contributes to the appeal of quality goods for sale is the level of detail and attention given to the design. For those who enjoy the tactile experience of shopping and the sense of discovery that comes with it, thrift stores offer a personal and immersive way to shop for second-hand items. For many, owning a quality product means owning a piece of history, a connection to something larger than themselves. Many sellers of second-hand electronics offer refurbished items, which have been inspected, repaired, and restored to a like-new condition. For some, selling a business is a proactive decision to move on to new ventures, while for others, the sale might be the result of external factors, such as market downturns, changing consumer preferences, or regulatory shifts. For the buyer, it can feel like a great opportunity, a chance to acquire something they’ve been searching for, or maybe just the satisfaction of knowing that a good deal is within reach. The result is a society that increasingly prioritizes consumption over connection, profit over meaning, and exchange over understanding. Business brokers play a key role in facilitating the transaction by acting as intermediaries between the buyer and seller. Legal experts are often involved at this stage to ensure that the transaction is conducted in compliance with all relevant laws and regulations. Perhaps the most troubling aspect of the idea that everything is for sale is how it can shape the way we view the world and each other. Therapists offer their services for a fee, and online courses promise to give us the knowledge we need to succeed — all in exchange for money. The world may increasingly operate under the assumption that everything is for sale, but the human spirit, with its capacity for love, creativity, and compassion, refuses to be bought. In some cases, buyers may also acquire businesses with existing intellectual property, such as patents, trademarks, or proprietary technologies, which can offer a competitive edge in the market.